AI-Driven Software Transforms Hedge Fund Operations: Maximizing Efficiency and Unlocking Data-Driven Insights

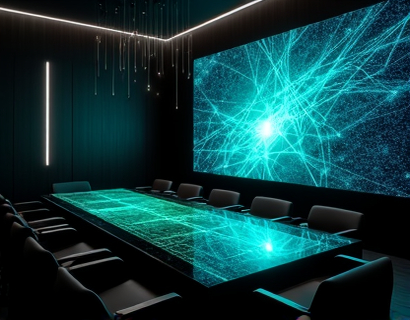

In the rapidly evolving landscape of finance, hedge funds are under constant pressure to optimize operations, enhance decision-making, and stay ahead of market trends. The integration of AI-driven software has emerged as a pivotal solution, transforming traditional hedge fund operations by automating complex processes and providing actionable insights. This transformation is not just about keeping pace with technological advancements; it's about redefining efficiency, accuracy, and strategic advantage in the competitive financial sector.

Optimizing Processes with AI

One of the most significant impacts of AI-driven software in hedge fund operations is the optimization of business processes. Traditionally, hedge funds have relied on manual data entry, manual analysis, and manual reporting, which are time-consuming and prone to human error. AI-driven tools automate these tasks, reducing the time and resources required for routine operations. For instance, AI can automatically scrape and process vast amounts of market data, execute trades, and generate comprehensive reports, freeing up financial professionals to focus on higher-value activities.

The automation of these processes leads to a more streamlined workflow. AI algorithms can identify inefficiencies and suggest improvements, ensuring that operations run smoothly and effectively. This not only saves time but also reduces operational costs, allowing hedge funds to allocate more resources to strategic initiatives.

Enhancing Decision-Making with Data-Driven Insights

Data-driven decision-making is the cornerstone of successful hedge fund management. AI-driven software provides unparalleled access to insights by analyzing vast datasets with speed and accuracy far beyond human capabilities. Machine learning algorithms can identify patterns, trends, and correlations that might go unnoticed by human analysts. These insights are crucial for developing and refining investment strategies, risk management, and portfolio optimization.

For example, AI can analyze historical market data, economic indicators, and news sentiment to predict future market movements. This predictive analytics capability enables hedge fund managers to make informed decisions, capitalize on emerging opportunities, and mitigate risks proactively. The ability to process and interpret complex data in real-time gives hedge funds a significant edge in a market where timing and precision are critical.

Risk Management and Compliance

Risk management is a critical aspect of hedge fund operations, and AI-driven software plays a vital role in enhancing this area. AI algorithms can monitor market conditions, identify potential risks, and provide real-time alerts, enabling hedge funds to respond swiftly to changing circumstances. This proactive approach to risk management helps in minimizing potential losses and ensuring compliance with regulatory requirements.

Compliance is another area where AI shines. Regulatory landscapes are complex and constantly evolving, and maintaining compliance can be a daunting task. AI-driven tools can automate the monitoring of regulatory changes, ensure adherence to reporting standards, and conduct internal audits. This not only reduces the risk of non-compliance but also saves time and resources that would otherwise be spent on manual compliance checks.

Portfolio Management and Optimization

AI-driven software significantly enhances portfolio management by providing sophisticated tools for asset allocation, rebalancing, and performance analysis. Machine learning models can optimize portfolio compositions based on predefined criteria such as risk tolerance, return objectives, and market conditions. These models continuously learn and adapt, ensuring that portfolios remain aligned with strategic goals and market dynamics.

Rebalancing portfolios is another task where AI excels. Traditional methods often involve manual calculations and periodic reviews, which can be inefficient and delayed. AI can automate rebalancing processes, executing trades at optimal times to maintain the desired asset allocation. This not only improves portfolio performance but also reduces transaction costs and market impact.

Customer Relationship Management

Building and maintaining strong relationships with clients is essential for the success of hedge funds. AI-driven customer relationship management (CRM) systems can enhance this aspect of operations by providing comprehensive insights into client behavior, preferences, and communication patterns. AI can analyze client interactions, predict future needs, and suggest personalized investment recommendations, fostering stronger client relationships and increasing client satisfaction.

Moreover, AI-powered chatbots and virtual assistants can handle routine client inquiries, freeing up human advisors to focus on more complex and value-added tasks. This not only improves client service but also enhances the overall client experience, leading to higher retention rates and positive word-of-mouth.

Challenges and Considerations

While the benefits of AI-driven software in hedge fund operations are substantial, there are challenges and considerations that professionals must address. One of the primary concerns is the integration of AI systems with existing infrastructure. Ensuring seamless compatibility and data interoperability is crucial for maximizing the benefits of these tools. Additionally, the quality and reliability of data are paramount. AI algorithms are only as good as the data they process, so maintaining high data standards is essential.

Another consideration is the need for skilled personnel who can effectively implement and manage AI-driven solutions. Hedge funds must invest in training and hiring professionals with expertise in AI and data science to fully leverage these technologies. Furthermore, ethical and regulatory considerations must be carefully managed to ensure that AI applications comply with industry standards and protect client data.

Future Trends and Innovations

The integration of AI in hedge fund operations is an evolving field, with continuous advancements on the horizon. One emerging trend is the use of natural language processing (NLP) to analyze unstructured data such as news articles, social media posts, and earnings calls. NLP can provide deeper insights into market sentiment and potential impacts on asset prices, further enhancing predictive analytics capabilities.

Another area of innovation is the development of explainable AI (XAI), which aims to make AI decision-making processes more transparent and understandable. This is particularly important in finance, where stakeholders need to trust and validate the insights provided by AI systems. XAI can help build confidence in AI-driven recommendations and support regulatory compliance.

Additionally, the convergence of AI with other technologies such as blockchain and quantum computing holds promise for even more transformative changes. Blockchain can enhance data security and transparency, while quantum computing can solve complex optimization problems at unprecedented speeds, further augmenting the capabilities of AI-driven hedge fund operations.

Conclusion

The integration of AI-driven software in hedge fund operations represents a paradigm shift, offering unparalleled efficiency, accuracy, and strategic insights. By automating routine tasks, providing data-driven insights, and enhancing risk management and portfolio optimization, AI is setting a new benchmark in the industry. As the financial sector continues to evolve, hedge funds that embrace these advanced technologies will be better positioned to thrive in a competitive and dynamic market. The future of hedge fund management is undoubtedly intertwined with the power of AI, promising a new era of innovation and success.